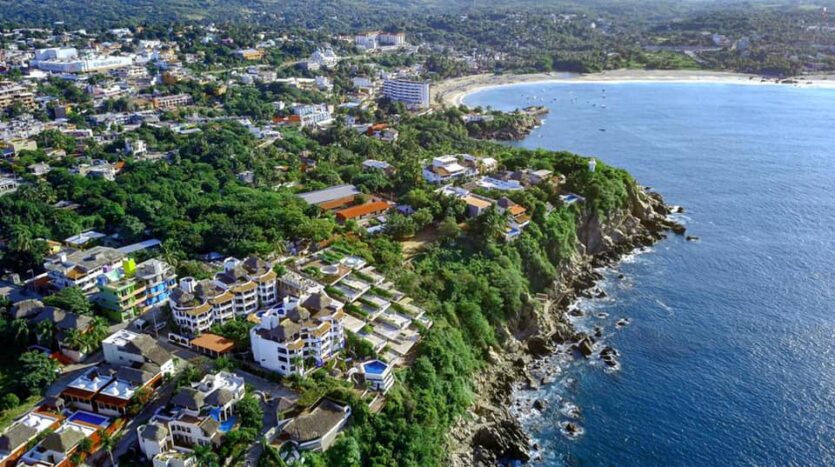

Puerto Escondido’s real estate market is experiencing an unprecedented surge, driven by infrastructure improvements, growing international recognition, and favorable market conditions. With property values appreciating steadily, enhanced connectivity through airport expansions, and the ongoing remote work revolution bringing digital nomads to this coastal paradise, investors are finding exceptional opportunities across Zicatela, La Punta, Bacocho, and Colotepec. Whether you’re seeking vacation rental income, a beachfront retirement home, or long-term capital appreciation, the convergence of multiple growth factors makes 2025 an optimal entry point into Puerto Escondido’s dynamic property market.

Infrastructure Development Driving Property Values

Puerto Escondido’s infrastructure evolution represents a pivotal moment for real estate investors. The expansion of Puerto Escondido International Airport has dramatically improved accessibility, with new direct flights from major North American cities reducing travel barriers that historically limited property demand. According to Mexico’s Secretariat of Communications and Transportation, investment in Oaxaca’s coastal infrastructure continues to prioritize connectivity improvements that directly benefit Puerto Escondido.

Road infrastructure connecting Puerto Escondido to Highway 200 has seen significant upgrades through municipal efforts in San Pedro Mixtepec and Santa María Colotepec, reducing travel times and improving access to previously undervalued neighborhoods like Colotepec and Bacocho. These improvements have catalyzed property appreciation rates of 8-12% annually in outer zones, while established areas like Zicatela and La Punta maintain steady 6-8% growth.

Utilities and Services Expansion

Municipal water system improvements and expanded electrical grid capacity have opened previously undevelopable land parcels for residential and commercial projects. Neighborhoods that once struggled with basic services now offer reliable utilities, making them viable for year-round residence and vacation rental operations. This infrastructure maturation has particularly benefited Rinconcito and upper Bacocho, where land prices have increased 40-60% since 2022 as development feasibility improved.

Tourism Growth and Vacation Rental Profitability

Puerto Escondido’s recognition as a world-class surf destination and emerging cultural hotspot has driven exponential tourism growth. The town now attracts over 500,000 visitors annually, with peak season occupancy rates for well-managed vacation rentals reaching 85-95% in prime locations. Properties within walking distance of Playa Zicatela command nightly rates of $150-400 USD during high season, generating annual gross yields of 10-15% for properly positioned investments.

| Neighborhood | Average Nightly Rate (High Season) | Occupancy Rate | Annual Gross Yield |

|---|---|---|---|

| Zicatela Beachfront | $250-400 USD | 85-95% | 12-15% |

| La Punta | $200-350 USD | 80-90% | 10-14% |

| Carrizalillo | $180-300 USD | 75-85% | 9-12% |

| Bacocho | $150-250 USD | 70-80% | 8-11% |

The vacation rental market benefits from Puerto Escondido’s extended high season, spanning November through April with secondary peaks during Easter week and summer surf competitions. Major international surf events and growing recognition in travel media continue to expand visitor demographics beyond traditional surfers to include wellness tourists, digital nomads, and cultural travelers seeking authentic Oaxacan coastal experiences.

Digital Nomad Influx Creating Long-Term Rental Demand

The remote work revolution has positioned Puerto Escondido as a preferred destination for digital nomads seeking affordable coastal living with reliable internet infrastructure. Properties offering dedicated workspaces, high-speed internet, and modern amenities can secure 3-6 month rentals at $1,200-2,500 USD monthly, providing stable income during traditional shoulder seasons. This demographic has proven particularly valuable for investors in apartments and condominiums located in quieter neighborhoods like Rinconcito and upper La Punta.

Favorable Market Conditions and Property Values

Puerto Escondido’s real estate market currently offers exceptional value compared to established Mexican beach destinations. While Tulum and Playa del Carmen have experienced price inflation that challenges investment returns, Puerto Escondido maintains accessible entry points with superior appreciation potential. Beachfront condos in Zicatela range from $200,000-450,000 USD, comparable properties in Tulum command $400,000-800,000 USD, highlighting the value proposition available to investors entering Puerto Escondido now.

According to data from INEGI, Oaxaca’s coastal municipalities have experienced consistent economic growth driven by tourism development, with Puerto Escondido leading regional property appreciation. The combination of accessible pricing, strong rental yields, and capital appreciation creates a compelling investment thesis across multiple property types and neighborhood zones.

Property Type Investment Opportunities

- Beachfront Condos: Turnkey vacation rental investments in Zicatela and La Punta with established management infrastructure, ideal for passive investors seeking immediate income generation

- Development Land: Strategic parcels in Colotepec and Bacocho offering 30-50% lower per-square-meter costs than developed zones, suitable for custom construction or subdivision development

- Existing Villas: Move-in ready properties in Carrizalillo and upper neighborhoods providing immediate occupancy or rental income with established amenities and services

- Commercial Properties: Retail and hospitality opportunities along the Carretera Costera and Zicatela’s main strip benefiting from increasing tourist foot traffic and local economic expansion

Investors can explore current opportunities across these categories through our comprehensive property listings, featuring detailed information on location, pricing, and investment potential for each available property.

Legal Framework Favoring Foreign Investment

Mexico’s well-established fideicomiso system provides secure property ownership mechanisms for foreign buyers in coastal restricted zones, including all of Puerto Escondido’s beachfront areas. This 50-year renewable bank trust offers functionally equivalent ownership rights, allowing foreign investors to buy, sell, lease, and inherit properties with the same legal protections afforded to Mexican nationals. The process has become increasingly streamlined, with experienced notarios in Puerto Escondido facilitating transactions efficiently for international buyers.

Recent regulatory clarifications have further simplified the acquisition process, reducing bureaucratic barriers and transaction timelines. Working with established local professionals familiar with Puerto Escondido’s specific municipal requirements ensures smooth closing processes, typically completed within 60-90 days from offer acceptance. Our detailed guide on navigating Puerto Escondido real estate transactions provides comprehensive information for buyers new to the Mexican property market.

Financial and Taxation Considerations

Property taxation in Puerto Escondido remains remarkably favorable, with annual predial (property tax) typically representing 0.1-0.3% of assessed property value. Acquisition costs including notario fees, registration, and transfer taxes generally total 5-7% of purchase price, significantly lower than many international markets. These carrying costs enhance net investment returns, particularly for vacation rental operations where operating expenses remain manageable relative to gross income potential.

Market Timing and Entry Strategy

Several converging factors create an optimal window for Puerto Escondido real estate investment in 2025. Currency exchange rates remain favorable for USD and EUR buyers, infrastructure projects are driving accessibility improvements before widespread value recognition, and the vacation rental market continues expanding with strong occupancy and rate growth. Early-stage infrastructure development historically precedes significant property appreciation, positioning current investors to benefit from upcoming value creation.

Successful entry strategies vary by investment objective and capital availability. Conservative investors often begin with turnkey vacation rental condos in established zones like Zicatela, generating immediate returns while familiarizing themselves with the local market. More aggressive approaches include land banking in emerging neighborhoods or developing custom properties that maximize site-specific advantages. Our team’s deep market knowledge across Puerto Escondido’s diverse neighborhoods enables tailored investment strategies aligned with individual goals and risk tolerance.

Neighborhood-Specific Investment Opportunities

| Neighborhood | Investment Profile | Price Range | Best For |

|---|---|---|---|

| Zicatela | Established, high-demand | $2,500-4,000/m² | Vacation rentals, immediate income |

| La Punta | Premium, lifestyle-focused | $2,800-5,000/m² | Personal use, luxury rentals |

| Carrizalillo | Residential, family-oriented | $2,000-3,500/m² | Long-term living, mixed use |

| Bacocho | Emerging, development opportunity | $1,200-2,500/m² | Capital appreciation, land banking |

| Colotepec | Value, pre-development | $800-1,800/m² | Patient investors, development projects |

Each neighborhood offers distinct advantages depending on investment timeline, management involvement preferences, and return objectives. Properties requiring renovation or development demand greater involvement but often deliver superior long-term returns, while turnkey options provide immediate cash flow with minimal management burden for absentee owners.

Risk Mitigation and Due Diligence

Successful Puerto Escondido real estate investment requires thorough due diligence and professional guidance. Title verification through experienced notarios confirms clean property ownership without encumbrances, while physical inspections assess construction quality and identify maintenance requirements. Environmental considerations including coastal erosion patterns, flood zones, and ecological protections should inform property selection, particularly for beachfront and low-lying parcels.

Engaging qualified professionals throughout the acquisition process protects investment capital and ensures regulatory compliance. Essential team members include a trusted notario público for legal documentation, a qualified property inspector for construction assessment, and experienced local real estate advisors familiar with neighborhood-specific considerations. For foreign buyers, working with bilingual professionals who understand both Mexican legal requirements and international client expectations proves invaluable for smooth transactions.

Market Volatility and Appreciation Outlook

While Puerto Escondido’s growth trajectory appears robust, prudent investors recognize potential risks including hurricane exposure, infrastructure project delays, and tourism market fluctuations. Diversification across property types and locations, maintaining adequate insurance coverage, and realistic financial projections accounting for vacancy periods and maintenance costs help protect against downside scenarios. Historical data suggests Puerto Escondido’s appreciation rates demonstrate consistency exceeding Mexico’s national average, supported by limited coastal land supply and sustained demand growth.

Conservative projections anticipate 6-10% annual appreciation across established neighborhoods through 2030, with emerging areas potentially delivering 10-15% as infrastructure improvements unlock development potential. These estimates assume continued tourism growth, stable political and economic conditions, and ongoing infrastructure investment, with actual results varying by specific property characteristics and management quality.

Getting Started with Puerto Escondido Investment

Beginning your Puerto Escondido real estate investment journey requires strategic planning and local expertise. Initial steps include defining investment objectives, establishing budget parameters including acquisition and operating costs, and researching neighborhood characteristics aligned with your goals. Visiting Puerto Escondido to experience different zones firsthand, meet local professionals, and view available properties provides invaluable context that remote research cannot replicate.

Our team offers comprehensive support throughout the investment process, from initial property identification through closing and ongoing management. Services include market analysis customized to your investment criteria, property tours across relevant neighborhoods, transaction coordination with notarios and other professionals, and optional property management for vacation rental operations. Whether you’re seeking a beachfront villa, development land, or commercial opportunity, we provide the local knowledge and professional guidance essential for successful Puerto Escondido real estate investment.

Conclusion

Puerto Escondido’s real estate market presents a compelling investment opportunity driven by infrastructure development, tourism growth, favorable pricing relative to comparable destinations, and established legal frameworks protecting foreign ownership. The convergence of these factors in 2025 creates an optimal entry window before widespread value recognition drives significant appreciation. Whether pursuing vacation rental income, long-term capital gains, or lifestyle properties in paradise, Puerto Escondido offers exceptional potential for informed investors willing to engage with this dynamic coastal market.

Ready to explore Puerto Escondido real estate opportunities? Contact our team for a personalized market consultation and property tour. Subscribe to our newsletter for ongoing market updates, new listings, and investment insights that keep you informed about Puerto Escondido’s evolving real estate landscape. Follow us on Instagram and Facebook for daily property showcases and market news.